At Southeastern Ohio Credit Union,

you’re a Member not a Customer

What is our mission?

Southeastern Ohio Credit Union is owned by the membership and exists to provide, in a friendly atmosphere, high quality financial services at favorable terms to its members while maintaining the long-term financial stability of the credit union.

What is a credit union?

It is a cooperative society organized under Ohio law with two primary objectives. First, to supply the members with a plan of systematic savings. Second, to make it possible for members to take care of credit needs at a reasonable rate of interest.

How can I join the Credit Union?

Click here to see if you are eligible. Visit or call the Credit Union office:

- Fill out a membership account card.

- Provide proof of identification.

- Initial Deposit of $5.00 required at the opening of the account or completion of a payroll deduction card.

Why join a Credit Union?

The credit union in another choice for various types of savings. Dividends are paid quarterly and at competitive rates. A minimum balance of only $5.00 is required to be kept in your savings account with no penalties for withdrawals. A variety of loans are offered with competitive rates. Checking accounts require no minimum monthly balance and have no monthly service charge.

Why Should You Choose The Credit Union??

Choosing the Credit Union to take care of your banking needs is the smart choice!! Credit Union’s are member owned, so being a member makes you an owner and gives you a vote! Credit Union’s are not for profit cooperatives unlike your traditional banks which are strictly for profit. Banks give their profits to their shareholders while credit unions give back profit to their members in the form of higher savings rates and lower loan rates.

A Credit Union’s board of directors are all volunteers, unlike banks which have a highly paid board of directors. We are privately insured through American Share Insurance (ASI) rather than FDIC insurance which is backed by the government. ASI is held to a higher standard than insurance upheld by the federal government.

If you are considering joining the Credit Union and have any more questions, please call one of our offices and someone from our member service team can assist you.

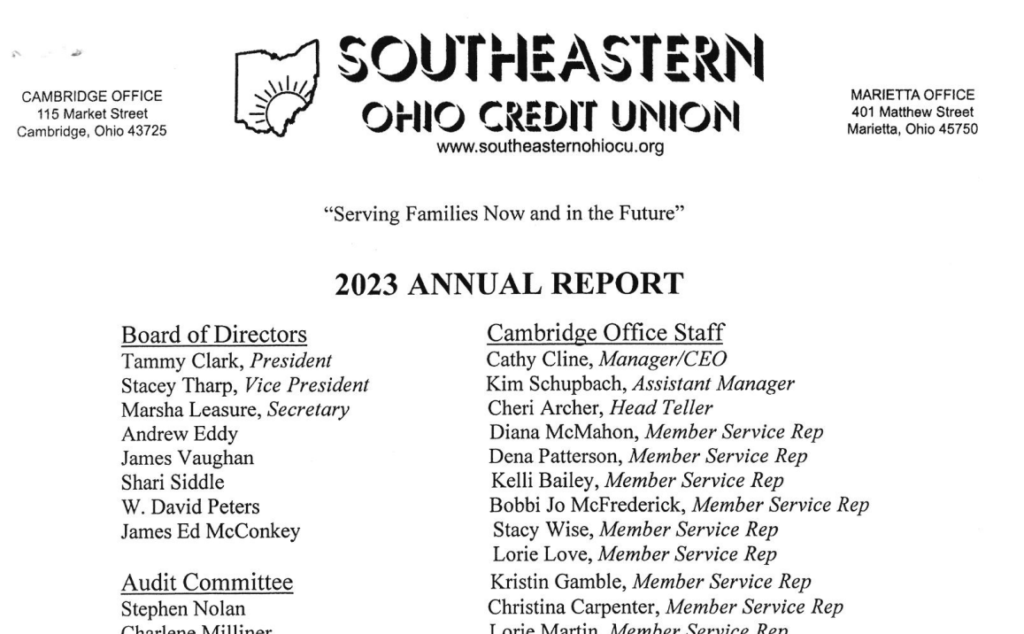

2023 Annual Report

Our annual report is here! Partners are welcome to read, and print, a copy of their own.

Click here to read the 2023 Annual Report. You will need the Adobe® Reader® to view or print the above files. Click here to download a free copy of the Adobe® Acrobat Reader®

Credibility Report

Click here to read the Summer issue of the Your Credibility newsletter. You will need the Adobe® Reader® to view or print the above files. Click here to download a free copy of the Adobe® Acrobat Reader®